You will find if Payoneer is suitable for your needs and some Payoneer alternatives to help you make a better decision in this new Payoneer review.

There are lots of ways to transfer money online, right?

But, not EVERY global money transfer services support all nations, countries. Ex: PayPal (There are still a few PayPal not supported countries)

For that reason, should you avoid doing your online business? Shouldn’t you engage in your freelancing work? Charge from your customers? Shouldn’t buy stuff from Amazon, eBay, etc.?

Why not? You should…

But, how?

Here’s this NEW international money transfer service that comes in.

Yes, it is Payoneer®.

Payoneer is a global money processing service similar to PayPal, yet it has a few distinct features. In this Payoneer review, I will look at Payoneer and explain how you can benefit from it. And will show you how far Payoneer is effective and useful for your online marketing affairs.

Payoneer Review

Use the links below at the Table of Contents to navigate through the Payoneer review.

What is Payoneer?

Before we go through the full Payoneer review, you may want to know what exactly Payoneer is.

Payoneer is a financial services business that provides online money transfer and e-commerce payment services founded in 2005 with $2 million in seed funding from then-CEO Yuval Tal and other private investors. Currently, Scott Galit is the CEO of Payoneer inc.

Payoneer provides various services related to money transferring such as wire transfers, online payments, account-to-account money transfers, reloadable prepaid master debit cards. And also, account holders can withdraw their money from Payoneer to local bank accounts (available to only a few countries) or their e-wallets. Currently, Payoneer is available for more than 100 currencies in 200 countries.

When someone pays through Payoneer Mastercard (ex: buy goods from the local supermarket), payments will automatically be converted into local currency. Payoneer also provides a US payment service, by which you can get a free USA bank account (USA virtual bank account).

In fact, Payoneer is a must-use online money transfer service by everyone, especially people who are located outside of the united states and want to receive money through US companies quicker.

Who uses Payoneer?

Within the previous decade, Payoneer service rapidly spread all over the world and so many US companies started supporting Payoneer as a reliable online money processing service. Here are a few companies that accept payments and payouts from Payoneer.

- 123RF

- 2Checkout.com Inc.

- 99designs

- Amazon.com

- Amway Corporation

- Avangate

- Airbnb

- Elance

- Digital River

- Fiverr

- Envato INC (includes all websites within the Envato network such as Envato Studio, Themeforest, etc.)

- GoDaddy.com

- Hide My Ass!

- iStockPhotos

- Infolinks

- Welocalize

- Google Inc

- Keynetics Inc. (ClickBank)

- Linkshare

- oDesk

- Microsoft Corporation

- ShareASale.com

- uShip

- Impact

- Paddle.net (SaaS products such as Convertful lets to withdraw money to your Payoneer with Paddle payment processor)

- Most TapAffiliate affiliate sites

- Semrush (via US banking)

Besides these companies, you can get payments from other companies instantly using Payoneer’s US payment service.

Many freelancers who are located in Asia and Africa use the Payoneer payment service efficiently. Because it is compatible and most times your payments are available within 2-3 hours.

Is Payoneer for you?

If you are a blogger, internet marketer, or freelance worker, then the Payoneer payment service is suitable for you. In most service companies, you can find that Payoneer is an available money withdrawal option.

If your country is not a PayPal-supported country, then Payoneer should be your best choice. If you need a fast payment service supported worldwide, then Payoneer could be your best money processing service.

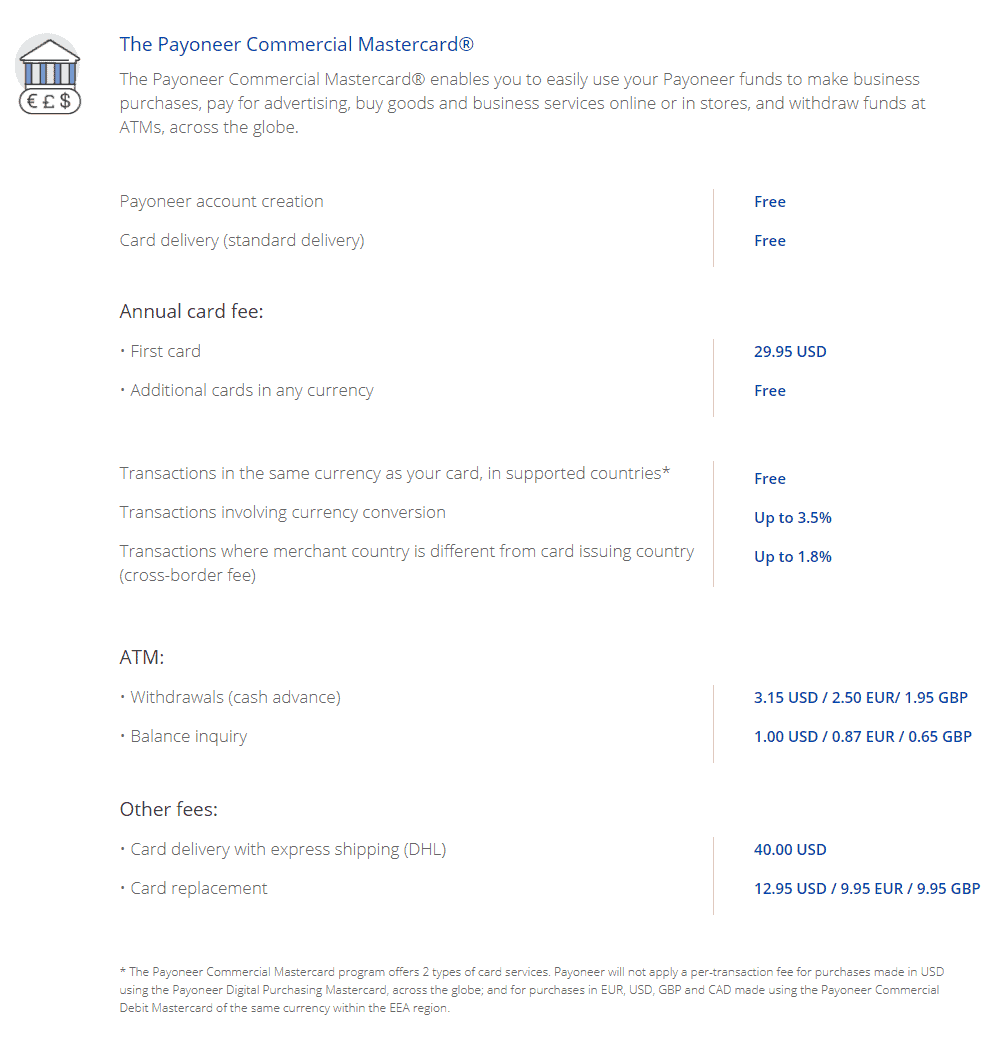

The applicant must be at least 18 years old to apply for a Payoneer account. See Payoneer terms of service here. You will not be charged any fee when creating your account and receiving your MasterCard. But, Payoneer charges a yearly fee and a fee when you withdraw money from your local ATM. (More on that later…)

Benefits

By using Payoneer as your online money processing service, you could get lots of advantages. Here are a few of them.

Security

Payoneer constantly improves its technology to ensure customer privacy and authentication. So you don’t need to worry about the protection of your Payoneer account. You can set up three security questions that will be asked whenever some fraud login attempts for your account. Only you know the answers, so only you can log in to your account.

Also, Payoneer deactivates your Payoneer MasterCard when you don’t use your Payoneer account for a while. You can activate your Mastercard again. But, this is a good move to ensure your money is safe with Payoneer.

Free MasterCard

I don’t know any other way you can get a free MasterCard. Payoneer offers every account holder a free MasterCard, which is supported in every country. So you can withdraw your earnings through your local ATM within minutes. Also, Payoneer will replace another card if you lost your existing MasterCard.

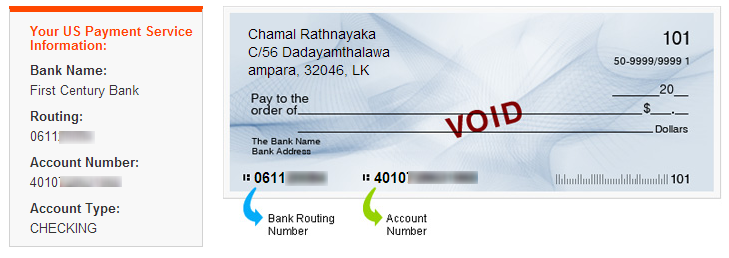

Free USA Virtual Checking Bank Account

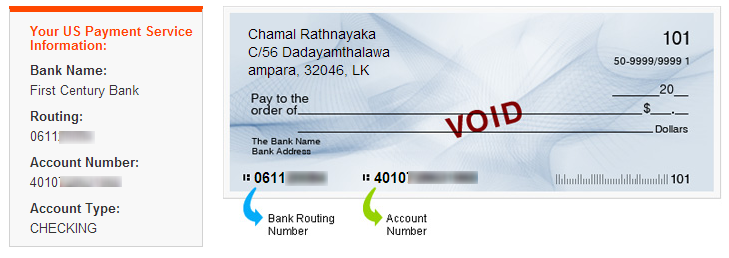

This is one of the best offers Payoneer provides to people. With Payoneer’s US payment service, you can open a free virtual US bank account. To open this account, you should fulfill some requirements, but you can open a US bank account online for free once you get these requirements.

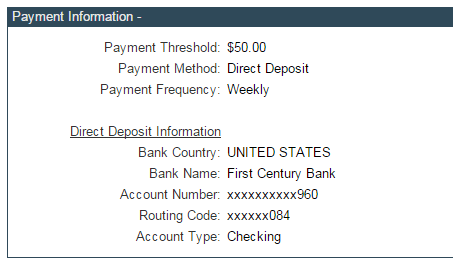

I use my US virtual Bank account to receive money from US companies and other European companies which offer direct deposit to US bank accounts as a payment option. I never need to wait and see weeks to get my paychecks. With a US bank direct deposit, I can withdraw my earnings within a few minutes.

Get European Bank Accounts to Receive Money from European Companies Faster

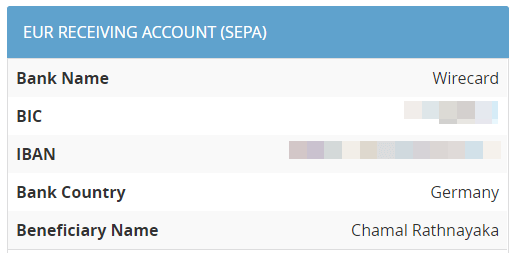

Yes, now you can receive money from European companies faster and easier. When you have a Payoneer online account, the Payoneer team will open a European bank account for you. I got two EU bank account (Wirecard) that is based in Germany.

So, when you want to receive a payment from a European company next time, provide them your checking bank account details. They will deposit money, and you can transfer them into your local bank or withdraw them using your prepaid MasterCard.

Easy-to-use

As many US and European companies accept Payoneer as a reliable payment system, you can set up Payoneer as the default payment method with two three clicks.

Also, Payoneer’s MasterCard® debit card is very convenient to use. You can easily pay bills, pay subscription fees to services such as ThriveCart, and shop online.

Currency

Payoneer supports over 100 currencies worldwide. No need to convert funds into the local currency you are dealing with. Payoneer MasterCard automatically converts them to the local currency at competitive rates.

Account to Account Money transfer

Now you can transfer money from one account to another easily with Payoneer. This is very helpful if you provide custom offers for your customers. If your buyer uses Payoneer, you can both benefit from Payoneer’s secure and fast one-to-one money processing service.

Transfer Money to local bank account

This feature is currently available for only a few countries. But, we can expect that Payoneer will enable this service to other countries as well. If you are in one of those countries where Payoneer’s direct bank deposit is supported, you can withdraw your money to your local bank account with just a few clicks. How awesome is that?

Multilingual Online support:

Unlike other online payment processing services, especially unlike PayPal, Payoneer has a customer support service that works 24x7x365. I have used the Payoneer Online chat service a few times and solved my problems within half an hour.

Cost-Effective

You will avoid fees when shopping online with Payoneer Card and sending funds to friends, relatives, and customers located abroad. Payoneer has low monthly fees for unlimited time uses.

Phone Apps to Check Account Balance:

Now you can download and install the Payoneer app for Android and iPhone phones. By using these apps, you can check your balance on your mobile phone for free. No need to use ATMs which take some time, and also charge a fee too.

Financial Responsibility

You only spend the amount that is loaded to the card. Payoneer MasterCard is a debit card, not a credit card. So you know that what your expenditures are. So you can manage your account responsibly.

Load Money from a local bank (savings or checking account) to Payoneer Account:

Like other payment processors, with Payoneer, you can easily deposit money to your Payoneer account via a local bank.

If you intend to use Payoneer to sell items online or pay for affiliates, servants, freelancers, etc., directly, then Payoneer is also a good solution. You can easily deposit money in Payoneer.

Different Payment options:

You can withdraw your money from a few different methods. They are,

- Deposits to local banks worldwide

- Prepaid Debit cards.

- Wire transfers (only available for a few countries)

- Global and local e-wallets

- Local-currency paper checks.

My experience with Payoneer so far…

In the tutorial on opening a US virtual bank account, I have explained my experience with Payoneer. When I first apply for Payoneer, I didn’t read the terms and conditions of Payoneer.

At that time, I was 17 years old. So my application was rejected. After I surpassed the 18 year age threshold, I contacted the Payoneer team and set up my account again. Within a few weeks, I received my Payoneer card.

Then applied to the US payment service to open a US bank account for me. Within a few days, my application was approved for the US payment service. After that, it was easier for me to send and receive money from Payoneer. With my online checking bank account (it is a First Century Bank account), I received online payments from ClickBank and other USA companies.

So far, I have received many payments from US and European companies. Also, I have used the Payoneer Card to recharge my prepaid SIM card and buy stuff online.

My last purchase was Hide My Ass! VPN (HMA!). It is a super VPN service by which I can change my IP location anywhere in the world.

As a blogger, internet marketer, and SEO, I know the importance of IP addresses and the usefulness of changing the IP location. You can check out the current numbers of servers and server locations of HMA VPN over here.

It has been over six years since I have started using Payoneer services for my financial circumstances.

Overall, I am happy with Payoneer, not only because it is a flexible and popular payment system that provides various payment services. Still, also their customer support service is on par. But, I think they can do much better in customer relationship management.

How to Apply for Payoneer

Every person over 18 years old can apply for a Payoneer account.

Before we start learning how to open your account, I would like to show what fees Payoneer charges from you.

When you apply for a Payoneer account, your card will belong to you, but payments are made with Payoneer. For my current card, the card sponsor is Avangate. If you apply through ShareASale, you will receive a MasterCard® debit card with the label of the ShareaSale logo. Same with other US companies.

Here are the Payoneer fees.

Note: Your Payoneer account’s charges could be different as your associated Payoneer mass payout company and card usage.

How to Apply for a Payoneer Account

Even though Payoneer is beneficial for people outside the USA, US residents can also open accounts for free. Here’s how to open your account shortly.

Step #1: Go to Payoneer over here.

Bonus: When you sign up to Payoneer through this link, your account will be loaded an extra $25.00 for free once your account is loaded with $1,000.

Step #2: Click the signup button and fill out the application form.

After you have successfully filled out the form, you will see a thank you page.

If your application has some errors, you will be notified that your application is declined. Like I got a few years ago.

If your application is error-free, you will receive a success message.

Step #3: Activate MasterCard® debit card.

The next step is to activate your MasterCard. It could take up to 2 weeks or more to receive your Payoneer card. It depends on your Geo-location and the mail delivery efficiency. Once it arrived, you should activate your master card.

You will receive a four-digit number associated with the letter. You need to submit that number to verify your card.

Log in to your Payoneer account and click on “Card Verification”.

Then provide your card information such as card number and PIN (you can enter a manual number you will use when withdrawing money from ATMs and other security cases).

Once you successfully activated your card, you will receive a message to your email account.

Step #4: Once your MasterCard and Payoneer application is approved, you are ready to apply for the Payoneer US Payment service. For this, you have to follow a specific way. For more information, read this article: Open a Free US Virtual Bank account for Non-US Residents using Payoneer.

Resources:

- Go to Payoneer

- Sign up on the ShareASale Affiliate Network

- Become Clickfunnels affiliate

- Fiverr

You will receive an email to your account.

Follow the instructions above to open a US bank account for you.

Once you have successfully followed the above steps, after a few weeks, you will receive another email from Payoneer.

Now you are ready to go with Payoneer!

Cons and what Payoneer should improve

Although Payoneer has lots of features and provides various services for business, internet marketing, and freelancing, there are still a few sides Payoneer should improve. A few of them, as my opinion is,

Payoneer Payment Processing integration to other third party services:

I have found that this is one of the biggest issues most bloggers and internet marketers encounter. If you live in one of those countries where PayPal is not supported, you know the importance of having a reliable and secure service to transfer money internationally, just like Payoneer.

But, unfortunately, we couldn’t find many more ways to integrate Payoneer with other systems and forms. I’ve used Jotform to collect information from my clients and readers. But, I really wish Payoneer has more integration options with tools such as ThriveCart, SamCart.

But now there’s a workaround to get Payoneer to work as a money holder by using Wise. (see the Wise section at the bottom of this Payoneer review.)

Payoneer “Buy” Buttons

PayPal is far ahead of Payoneer when it comes to collect payments from customers. PayPal is widely accepted, and many cart platforms such ThriveCart, SamCart, LeadCart, and Paddle fully support PayPal.

If Payoneer can offer online payment solutions for buyers, more people like product launchers, eCommerce site owners, Shopify site owners, etc., will start using Payoneer for their businesses.

Payoneer Donate button

This is a similar situation to the “Buy” buttons. I have seen that many people ask whether they can create Payoneer Donation buttons. If you want to use Payoneer for donations, you can’t use Payoneer currently to load funds automatically to your account.

Charges

Payoneer charges a fee every time you try to withdraw your money via ATM. That means, if it succeeds or not, you will be charged. Also, you are charged for every money transfer to your account.

But, it doesn’t cost any fee to receive money from another Payoneer account. (via Payoneer to Payoneer transfer)

Payoneer annual fees

Payoneer annual charges are $29.95. It is reduced from your Payoneer balance once every year.

Alternatives

I showed the best features, how I use them, and things I think Payoneer should improve in this Payoneer review.

If you are looking for sites like Payoneer to manage your money, send and receive payments, here are some of the best Payoneer alternatives.

Wise

Wise is a UK-based online money transfer service. It might be one of the best alternatives to Payoneer. Although it doesn’t offer unique Payoneer features such as virtual bank accounts, it’s still a good money transfer service for marketers.

It has got the popularity over last few years due to.

- Low-cost charges — Wise offers industry-leading fees

- Efficient — Anyone can send and receive money very quickly

- Local currency converter — You get the best rates

- Deposit money to a local bank account with the best exchange rates.

Unlike Payoneer, Wise is cheaper in sending and receiving money for both parties, efficient and user-friendly.

Here are some of the best Wise features.

Transfer tracker

You can track what happens with your transaction. Wise shows you where your money is at.

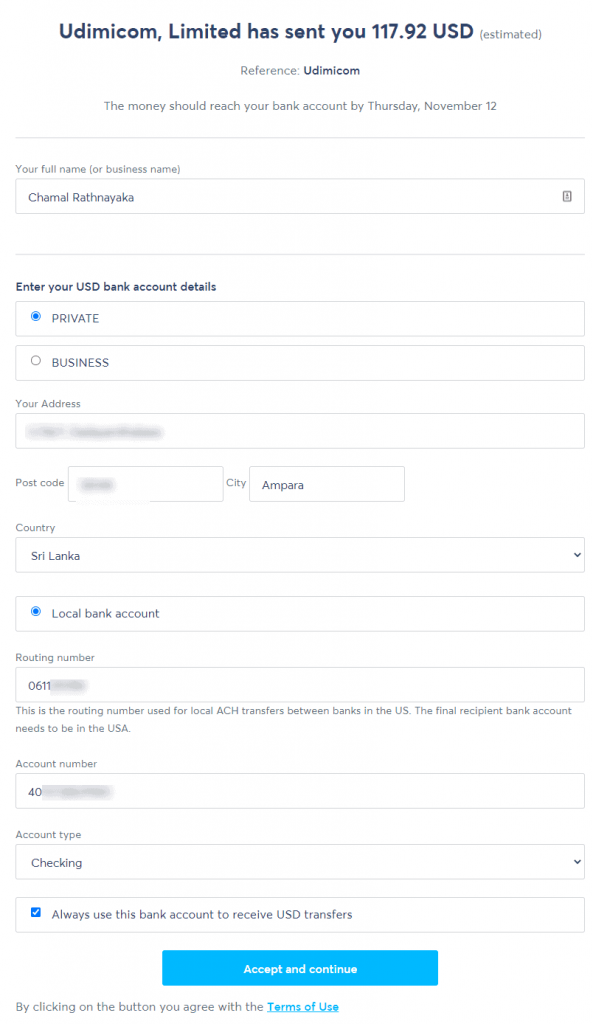

Here’s a screenshot of my recent transaction. I received my earnings from the popular solo ads marketplace called UDIMI.

Multi-Currency account

You could have multiple currencies under on Wise account and manage 30+ currencies such as USD, AUD, Euro, GBP, INR, LKR, Yuan, Ruble, Yen with low exchange rates.

Save more money

Who doesn’t want to save money? I’ve saved over €23 with a small transaction. Think of how much money you could save when you transfer through Wise.

Ability to deposit money from any bank to Payoneer via Wise

Yes, you can use Wise as a money gateway and receive clients’ payments to Payoneer very easily. Here’s a recent transaction I made with Trasferwise. I used my Payoneer’s US bank account details.

Since Payoneer US virtual bank account service has not had a problem with ACH transfers, I received my earnings from Udimi without any hassle.

Payoneer vs Wise

Both services have common and unique features of their own. Here’s a comparison between Payoneer and Wise.

| Feature | Payoneer | Wise |

|---|---|---|

| Sign up | Free | Free |

| Hold & manage money | Yes | Yes |

| US Virtual Bank account | Yes | No |

| Deposit to Local bank account | Yes | Yes |

| Debit MasterCard® | Yes | Yes* |

| Transfer money by providing an email address | Yes | Yes |

| Multi-currency support | ||

| Integration with freelance networks such as Fiverr | Yes | No |

| Mobile application | Yes | Yes |

| Send money in own currencies (i.e: Yuan, Franc, Rupee, Ruble) | No | Yes |

* Available for limited countries

How to create your Wise account

It is free to get started. Watch this short explainer video on setting up a Wise account.

Special: When you sign up today by using this link, you will not be charged any fee of your first €500!

Payoneer Review Conclusion

The Internet has made a global village where people from all over the world have started their online businesses with various companies. Some have started their own business, such as building a website, launching an info product, etc. Others have become affiliate marketers, content writers, video game testers, video creators, graphic designers, Freelance workers through Fiverr, etc.

Many of these freelance workers work with large companies such as Upwork, Envato. Many of those are US companies. In countries such as Pakistan, Nigeria, and Sri Lanka, PayPal is not supported (cannot receive money from others). This is a huge problem for people living in those countries.

Payoneer is a good PayPal alternative and provides different services related to money processing (And not a scam too). With the help of Payoneer, you can get a free prepaid MasterCard and open a free US virtual Bank Account for your lifetime.

Already thousands of freelancers are using Payoneer to receive their earnings from US companies and use the Payoneer card to withdraw money from local ATMs. If you want a secure and compatible way to transfer money internationally, Payoneer would definitely be your choice.

Hope this review on Payoneer helped you out. If you have any questions regarding Payoneer, please drop them below.

So what is your best international money processing service? Share your reviews of Payoneer in the comment form below.

PayoneerFree

- Virtual Bank Accounts(5)

- Prepaid MasterCard(5)

- Customer service(2.8)

- Online payment options for small business(1.5)

- Fees and charges(3.5)

Summary

Getting payments from clients and companies that are located in another corner of the world could be irritating. But, Payoneer helps you getting payments easier than ever before with its global payment solutions, including virtual bank accounts and virtual debit cards. Since many affiliate networks already support Payoneer, you can use it as a Paypal replacement for instant and secure payments.

Pros

- Withdraw to a local bank account

- Invoices

- Amazon store integration

- Virtual bank accounts

Cons

- Poor customer service

- Lack of online payment options

- Lack of integrations with other tools and services